In recent years, Black Friday, typically the last weekend of November, has emerged as a peak period for bookings. This year, it spanned November 24-27. Both hotel establishments and online travel agencies (OTAs) recognize Black Friday as a crucial time for maximizing revenue. They strategically aim to secure as many reservations as possible during this period.

In this context, it’s essential to analyze the pricing behavior of OTAs, especially in terms of parity with the preceding weekend. Such analysis is critical for understanding market trends and identifying revenue-maximizing strategies.

Behavior of OTAs during the Black Friday period: parity and customers 123compareme

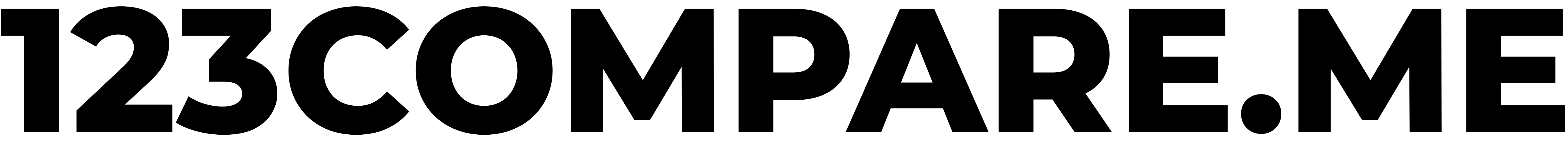

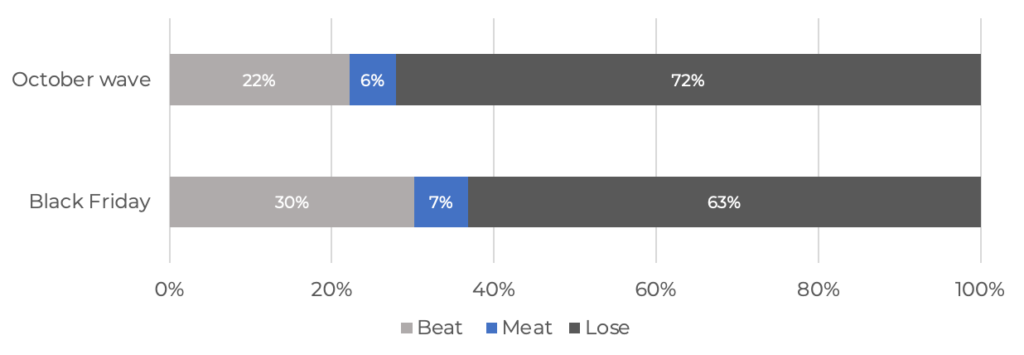

Regarding OTA pricing behavior, at 123compare.me, our analysis reveals no significant variations in key price competitiveness indicators—beat, meet, and lose—when compared to the reference weekend and our customers (refer to Chart 1 for details).

GRAPH 1. Black Friday (24-27/11) vs Previous Weekend (17-20/11)

Could we, therefore, affirm that there is no correlation between the pricing strategy of OTAs and Black Friday?

Indeed, it appears that Black Friday has not undermined the competitiveness of our customers’ direct pricing. However, it’s important to note a distinct bias in these findings. The establishments analyzed are exclusively hotels that prioritize pricing as a central component of their direct sales strategy. Additionally, these hotels have access to resources and tools, like those provided by 123compare.me, to effectively implement and monitor their pricing strategies.

Behavior of OTAs during the Black Friday period: parity and main destinations

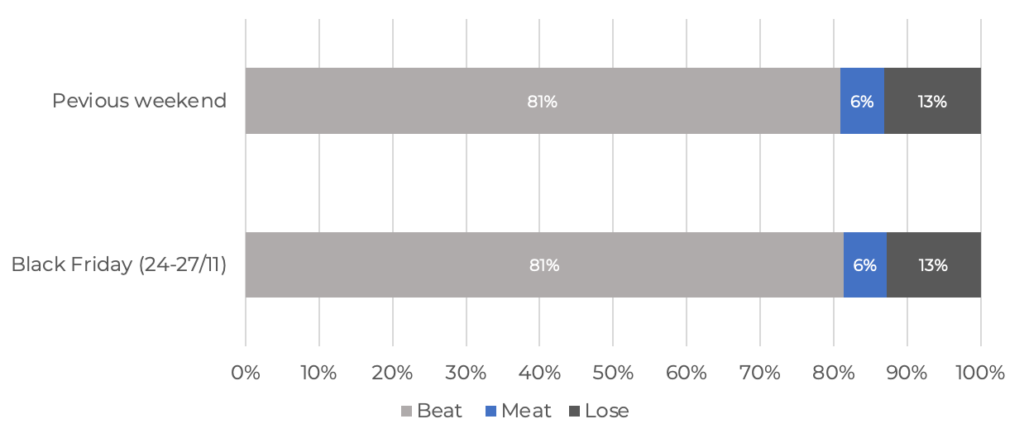

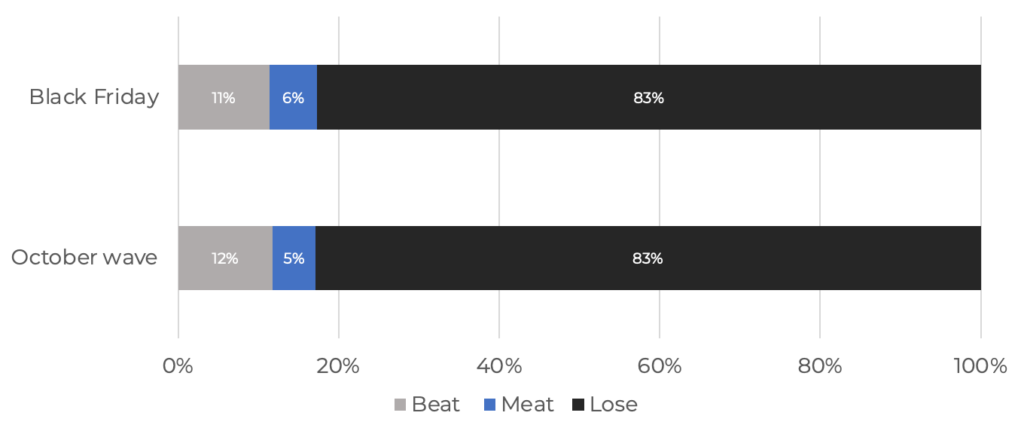

At 123compare.me, utilizing the same approach as in our World Parity Report, we’ve captured a fresh snapshot of the situation across major destinations. As illustrated in graphs 2 and 3, while there are no significant shifts in global indicators or among the leading OTAs, we have observed an aggressive surge of over 10% in sponsored placements, particularly in the top positions on Google Hotel Ads.

Put simply, during Black Friday, the OTAs offering lower prices than direct hotel websites gained increased visibility.

GRAPH 2. Global BML

GRAPH 3. Sponsored Placement

Behavior of OTAs during the Black Friday period: Impression Share

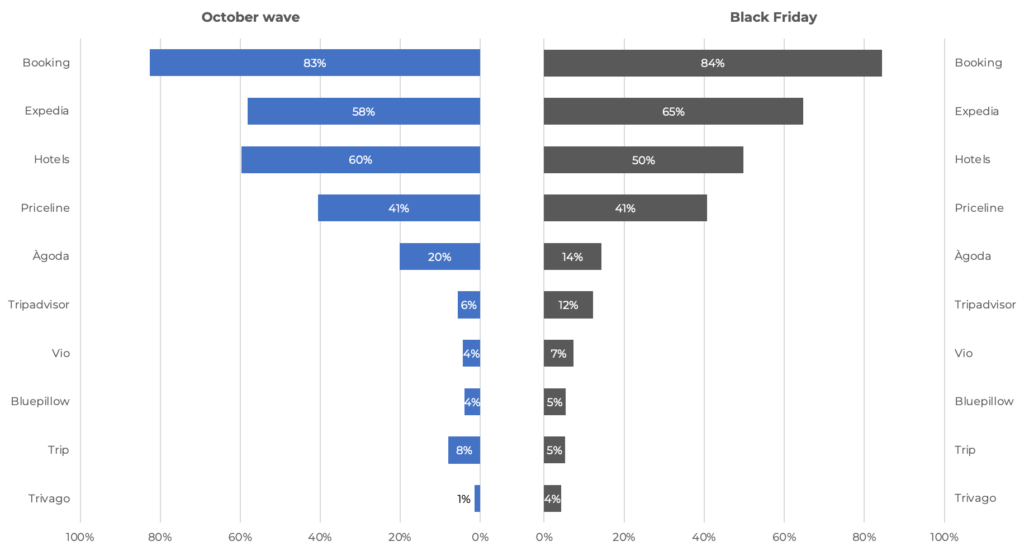

Overall, all the major OTAs have increased their impression share, appearing in a larger number of searches (as detailed in Chart 4). This data underscores the two primary strategic pillars of direct sales: price and visibility.

GRAPH 4. Impression Share

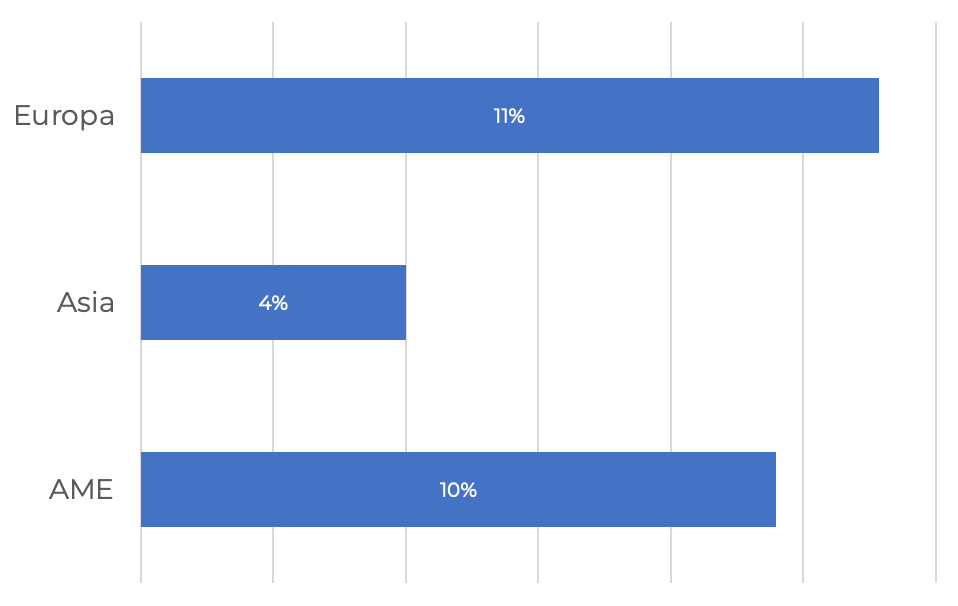

Considering all the analyzed data, an important question arises: Have OTAs exhibited uniform behavior across all destinations?

Black Friday, originally a Western phenomenon, has gained global recognition but remains more significant in the American and European continents. When examining the data by destination, it becomes evident that these continents show a notable increase in the ‘Lose’ rate, as depicted in Chart 5.

GRAPH 5. Increase in loss rate (average)

Bonus track: Palma de Mallorca Case, the outlier

Traditionally, Palma de Mallorca hasn’t exhibited the typical characteristics of an island holiday destination. In our analysis conducted in October, which is available for review here, Palma stands out as an exceptional case.

The industry knowledge accumulated on the island in recent years, fostered by various public and private institutions, positions this destination as a strategic model worth emulating.

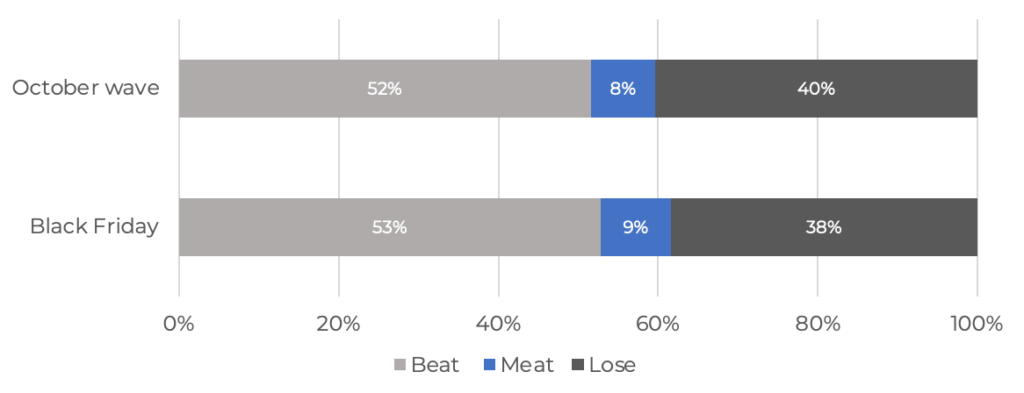

In terms of direct sales competitiveness, Palma has the lowest ‘lose’ rate among all analyzed destinations (as shown in Graphs 6 and 7). This indicates that hotels in Palma were well-prepared for Black Friday, clearly prioritizing their websites as the main sales channels.

GRAPH 6. Global BML Palma de Mallorca

GRAPH 7. Sponsored Placement Palma de Mallorca

While the analysis conducted in October already highlighted Palma de Mallorca for its low ‘lose’ rate, it’s important to note that this destination has further enhanced its competitiveness, becoming one of the most improved destinations globally during the Black Friday weekend.

WPR Work Team

Jordi Serra, CEO at 123COMPARE.ME

Pau Ferret, Chief Revenue Manager al 123COMPARE.ME

Fran Diéguez, VP of Product at 123COMPARE.ME

Salima Mansouri, Data Analyst at 123COMPARE.ME