DISPARITY ANALYSIS | APRIL 2024 WAVE

GLOBAL RESULTS

The global Beat-Meet- Lose rate for the April 2024 wave indicates that the pricing policies of OTAs, in general, have become slightly more aggressive compared to January 2024, with a two percentage point increase in the ‘Lose’ rate. However, it still does not reach the level observed in October 2023.

Specifically, the average for the period analyzed across the three waves ranges between 75 and 80 percent, confirming the date from the first report issued in October 2023: in three out of four instance, an OTA creates a disparity by offering a Price lower than the direct Price listed by the hotel on its website.

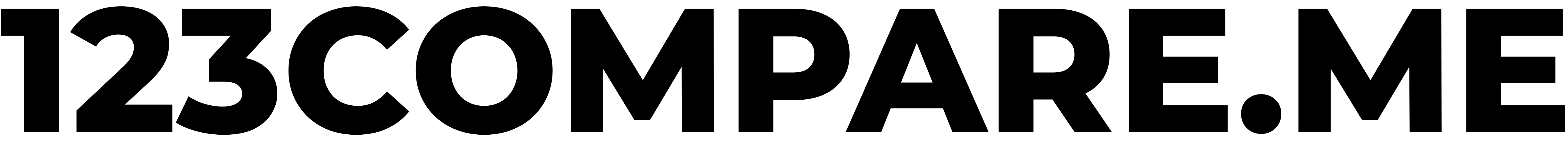

TOP OFFENDERS: April 2024

Regarding top offenders, major OTAs continue to develop less aggressive pricing strategies (Chart 2) compared to smaller OTAs.

B-M-L MAIN OTAs: Booking Holding and Expedia Group

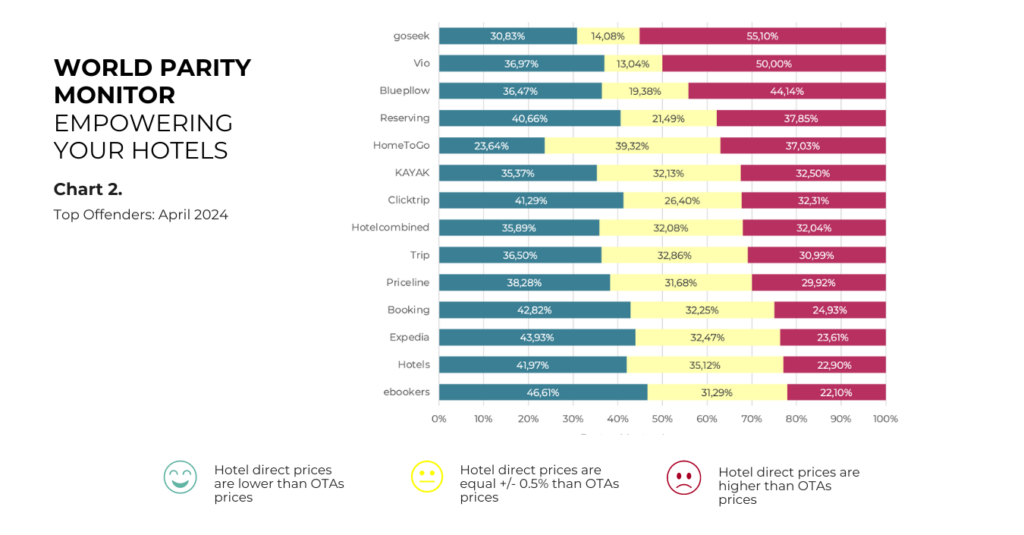

For Booking Holding and Expedia Group, there has been a shift in pricing strategy with increased pressure.

In this context, it’s important to note the aggressiveness of the pricing policy among the different intermediaries that make up the total offer of both group, analyzed individually, does not seem to show a significant increase in the ‘Lose’ rate compared to previous waves, fluctuating between 1% and 3%, depending on the OTA.

However, consolidating the data by looking at the global ‘Lose’ rate for each group shows a variation that represents a 5 percentage point increase compared to October 2023 and a 7 percentage point increase compared to January 2024 (Chart 3)

This could be related to the design of a pricing strategy by both Booking Holding and Expedia Group that aligns with a group-wide pricing, avoiding concentrating pressure (disparity) on any specific intermediary.

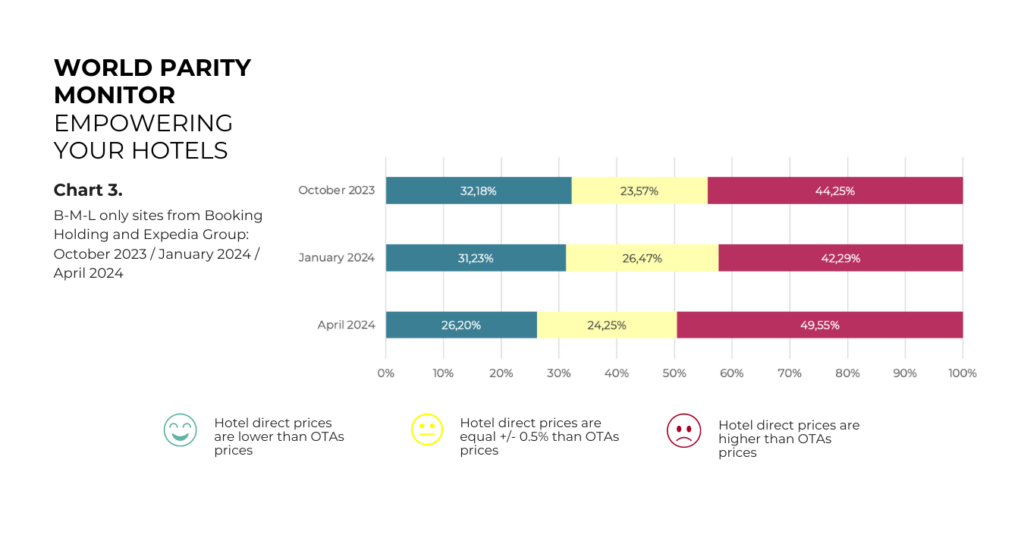

GOOGLE HOTEL ADS: Sponsored Links

Additionally, the observed pressure on sponsored links is particularly notable.

This trend of increasing aggressiveness in OTA pricing policies has resulted in an 8 percentage point increase since October 2023.

One reason might be related to how Google Hotels presents prices, similar to its approach in SERPs. Initially, there are four sponsored links (highlighted options section), followed by the Free Bookings Links (all options section), allowing an OTA or a hotel to appear simultaneously in both sections: SEM and SEO.

With this increased visibility in the metasearch engine, price differences become much more evident, potentially leading to a significant increase in bookings at OTAs offering the lowest rates, causing hotels to lose bookings, as well as paying commissions.

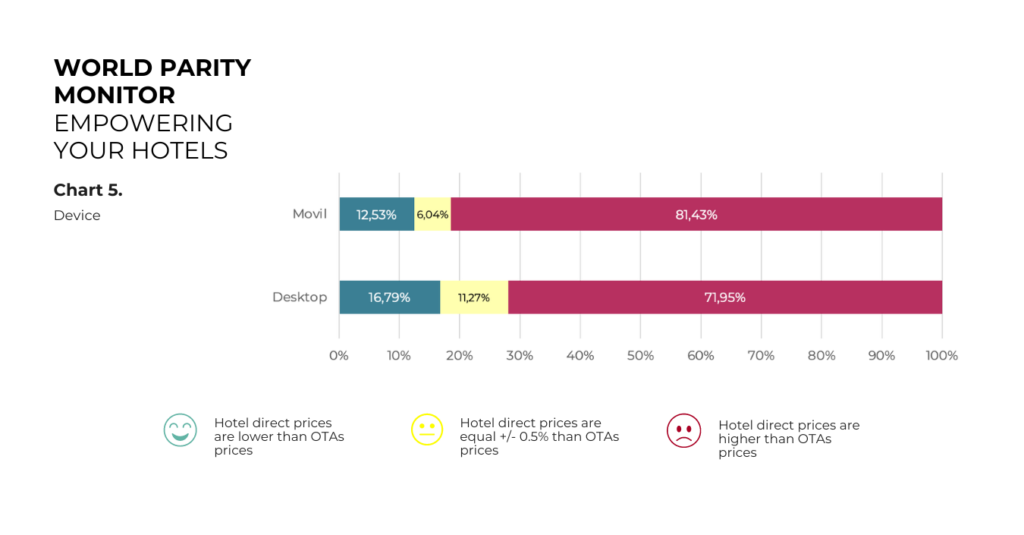

Disparities by “device”: mobile and desktop

The greater disparity on mobile devices is a common theme. One reason might be related to visibility boosters used by OTAs, which increase commissions or reduce margins, depending on the case.

Under the premise of “capturing the fastest growing customer segment,” Booking.com offers the possibility to activate a mobile-specific rate with an exclusive 10% discount, in exchange for a special tag in search results and on the accommodation page. The goal is to increase conversions.

The question is, will it generate enough revenue to offset the impact?

As a result, visibility boosters can be a double-edged sword for hoteliers, as they increase booking possibilities but are also subject to much more aggressive pricing policies.

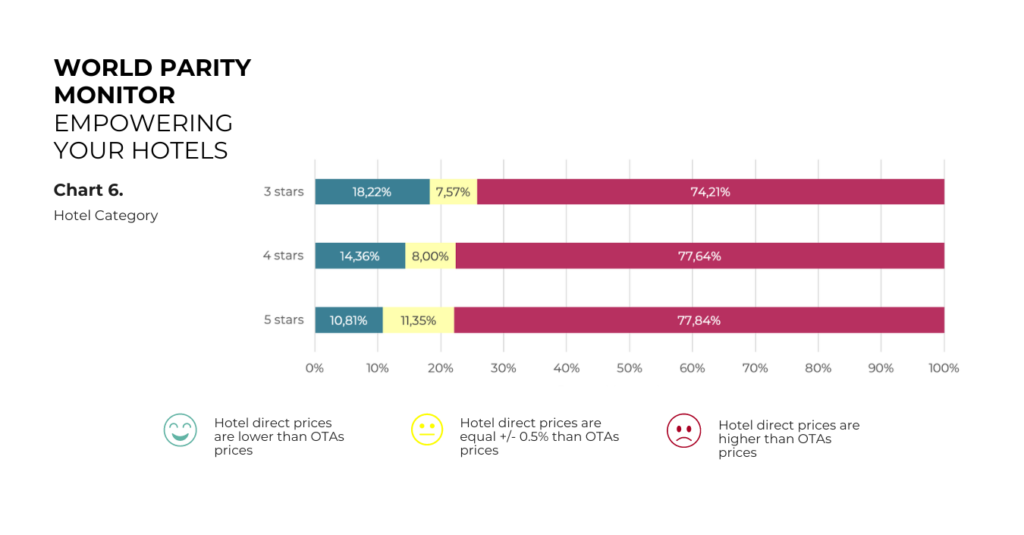

Anticipation, Duration of Stay, Market Segment, and Hotel Category

There are no significant differences in terms of anticipation, duration of stay, market segment, and hotel category between the different waves.

The disparities continue to be more aggressive when the anticipation is shorter, the stay is briefer, and the establishment is of a higher category (see Chart 6), with the greatest pressure also being on bookings made by the “couples” segment.

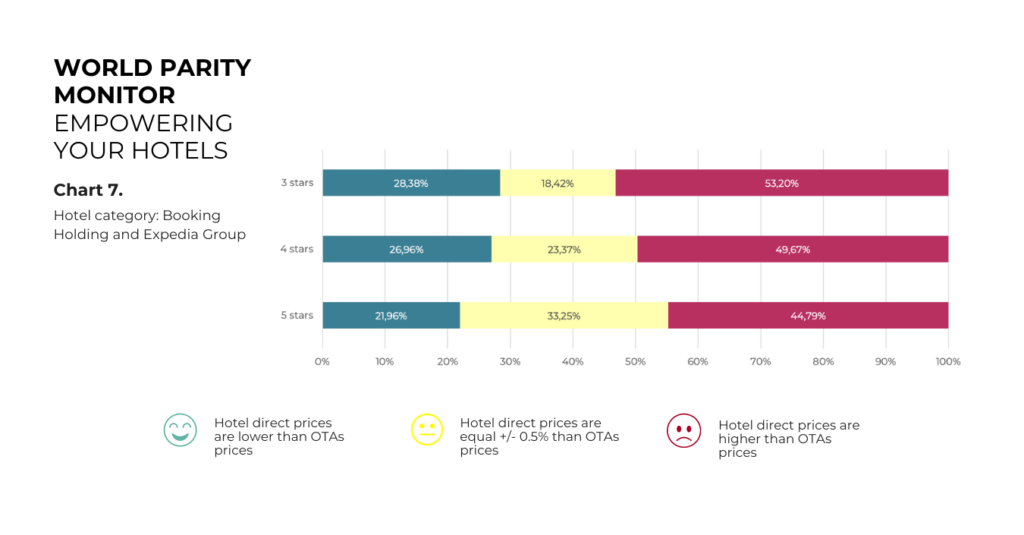

Nevertheless, it’s important to note that when we refer exclusively to Booking Holding and Expedia Group again (see Chart 7), it appears that three-star hotels are subject to greater pressure to the detriment of four and five-star establishments.

Therefore, we can conclude that for major OTAs, capturing traffic volume is a priority, while at high prices, there is always a smaller OTA willing to give up a percentage of commission for these higher rates.